Table of Contents

Pay Scale Salary for Pay band Pay Matrix of 37000-67000 After 7th Pay Commission

Well, after the proposal of 7th pay commission there are a lot of changes that have been implemented within the pay structure of the Indian central government employees. This is also really great news for those aspirants who are looking for government jobs and preparing for the examinations. Now that being said, this article is going to focus on a certain fraction of the new pay band and in hand salary that was offered in the 6th pay commission. The new pay format has some changes in the above pay bands, but to know what the changes that have been made are we are bringing this to you.

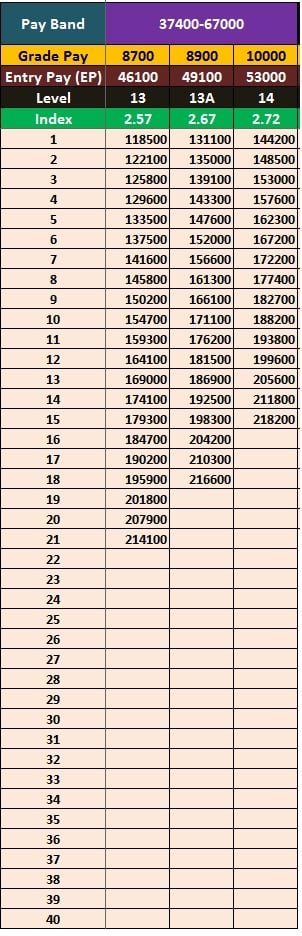

Pay Scale Salary for pay band Matrix of 37000-67000 After 7th Pay Commission

-

The doubts about pay band

A lot of candidates have no idea what the pay band of a salary of a government employee is. But this blog is going to remove all the confusion regarding the pay band and pay structure. So let us check out the formula that is used for the calculation of the in hand salary. But remember this is just an initial count of the in-hand salary when the candidate is joining for the first time without any increment.

- The formula is

Total In-hand salary = (basic + grade pay) + [% of DA*(Basic + Grade Pay) + HRA + Transport Allowance] – (PF + Taxes).

This is how the initial in-hand salary is calculated without increment.

Now it depends and varies according to different cities. The locations are divided into different cities like, City Type A (the metro cities) like Mumbai, Kolkata, Chennai,the city type A (Y) which are the big cities like Nagpur, Lucknow and Kanpur, City B1 and B2 (Y) like Allahabad, Kanyakumari, etc. And finally the City type C (Z), these are the unclassified rural areas. The gross salary also comprises of HRA, TA, PF, Taxes. You can reduce 7-8K every month if you have government quarters and own government vehicles for the pay band 2. If you are in government quarters and own government and you are within pay band 3, then you can deduct Rs 12-13k. With the 7th pay commission this is going to vary by 10-20%.

A tabular overview about the Pay band of 37000-67000

| SL NO | City type | Gross Salary in INR |

| 1. | A-1 | 149322 |

| 2. | A (Y) | 143301 |

| 3. | B-1 (Y) | 139989 |

| 4. | B-2 (Y) | 139989 |

| 5. | C (Z) | 133968 |

| 6. | *Z | 133968 |

For the * marked areas the pay scale gets varied according to the regional relocation and transfer since they are mostly posted within the rural areas.

Other :

- Judicial Staff Pay Scale Salary Matrix Allowance After 7th Pay Commission

- 7th Pay Commission In MP Madhya Pradesh Latest News Hindi

Also Read :